Travel insurance is important for today’s travelers. Enough coverage can bring peace of mind. It provides financial security in unexpected situations. It can protect travelers from financial crises. In the time of lost luggage, trip cancellation, or medical emergencies.

When choose the best travel insurance companies, keep in mind several factors. It’s important to evaluate the company’s reputation. This includes their coverage options, pricing, and customer service. Also, consider any added benefits or perks. By judging these factors well, travelers can pick the insurer that best meets their needs.

in this article we are providing common and best companies for travel insurance

Idea about the best companies for travel insurance

When you select the top travel insurance companies, consider certain guidelines. These guidelines help to find the companies. They give reliable coverage and great service. Some key factors to judge are coverage limits, policy inclusions, and exclusions. Also, the claim settlement process and customer feedback are important.

let’s explain some popular best companies for travel insurance

HTH Worldwide:

HTH Worldwide offers a difference of travel medical insurance in the U.S. under main brands. HTH Worldwide offers many travel health insurance plans. They include coverage of hospital, surgery, office visits, drugs, and medical clearance. HTH Worldwide has doctors in over 160 countries. When you Get A Quote, you will see travel health insurance products for the kind available in your area.

Nationwide:

It started as a small mutual auto insurance company. Now, it’s a nationwide increase. The world’s largest insurance and financial services company. They provide all of the insurance services. Include

car,

motorcycle,

Homeowners,

pet,

Farm,

life,

and commercial insurance.

They also include mutual funds, retirement plans, and special health services.

Think of travel insurance as an investment in peace of mind. It’s a small price to pay for the assurance that unexpected bumps won’t derail your entire trip.

Seven Corners :

It covers:

- Emergency Medical Evacuation and return home

- Trip Cancellation.

It covers lost, damaged baggage and travel accidents. It’s for any unexpected problem during travel.

Travel Insured :

Travel Insured is a growing travel insurance company. It provides products and services for international trip protection. For 25 years, Travel Insured have shown their value to customers. The coverage is high quality. It helps every traveler be secure and confident.

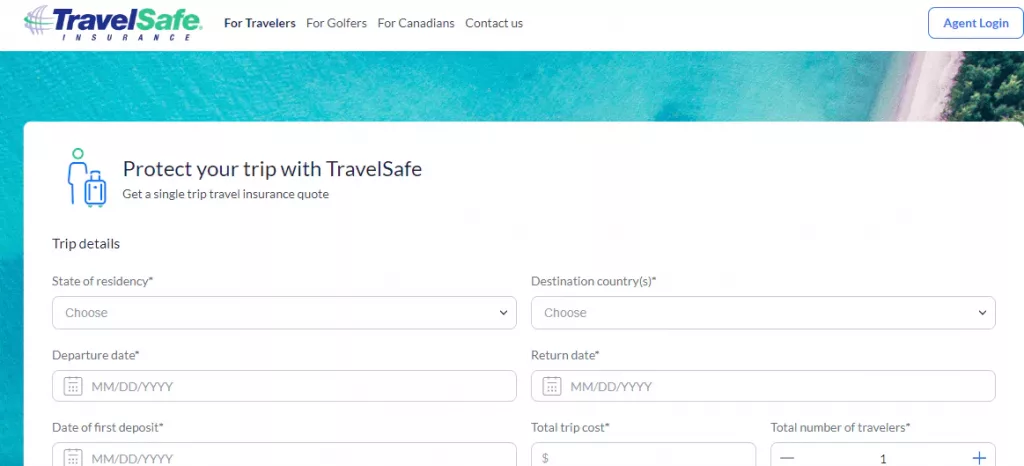

Travel safe :

Travel safe is one of the best travel insurance in usa. Travel Safe is provide there service in us. This is one of the leading private company for travel insurance.

Don’t gamble on luck while abroad. Pack your swimsuit, sunscreen, and a comprehensive travel insurance policy for a truly worry-free adventure.

WorldTrips :

Frequently travelers will appreciate for the exclusive benefits offered by WorldTrips . They have loyalty programs and bonuses for repeat customers. They provide value for those who often go on adventures. Additionally, they offer various travel-related services to enhance the overall travel experience. They provide all service of travelers.

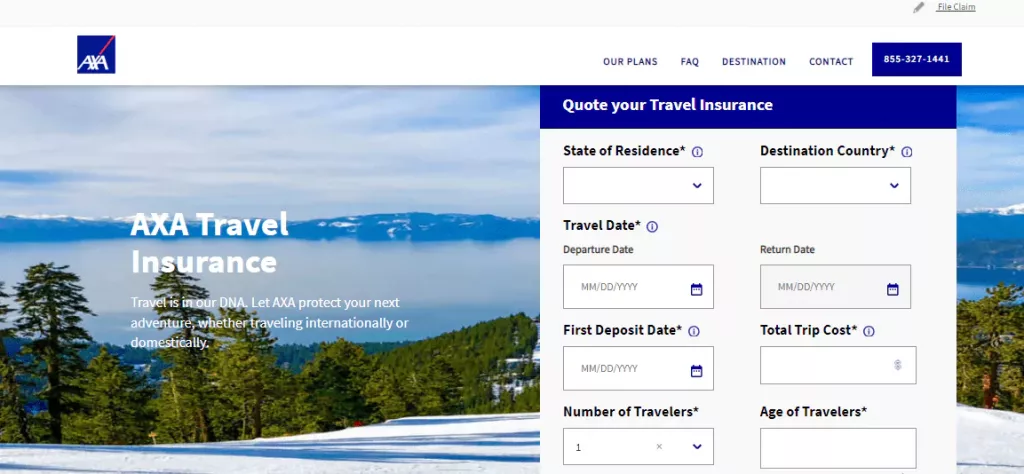

AXA Assistance USA:

They are in the market for 60 years. They provide service for emergencies. Their goal is to help the world in any emergency. Maybe everyone travel by help of this travel insurance company.

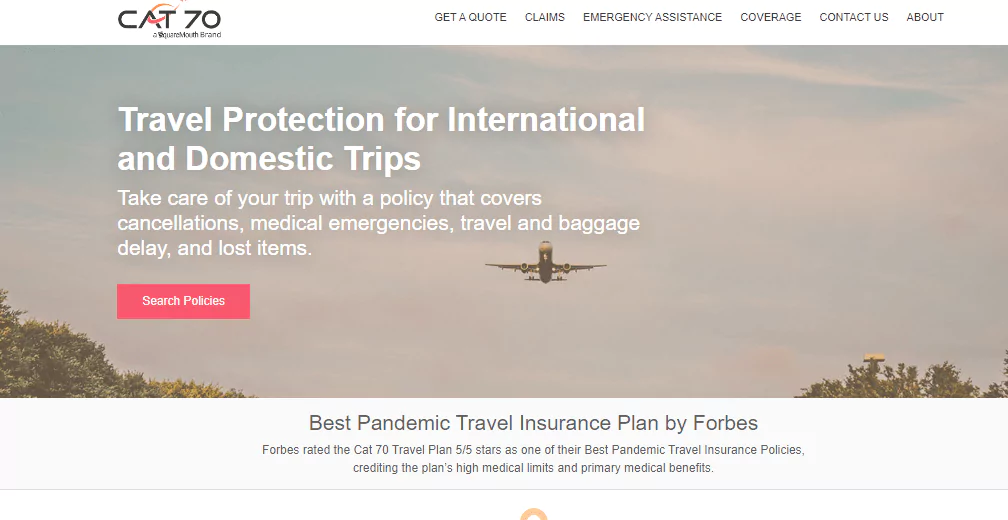

Cat 70 :

Cat 70 provides full reimbursement for cancellations. It also covers trip delays, interruptions, and missed connections. In the life’s unexpected problem is impact even for the most smooth-plan trips. Cat 70 offers travelers lowest coverage what is meets with their needs. Cat 70 offers 24/7 emergency support for traveler.

Generali Global Assistance:

Simplifying the claims process is a priority for Generali Global Assistance. They utilize innovative technology, including mobile apps, to simplify claim submission. Travelers can submit their claims digitally. This reduces the paperwork and time for processing. Optionally, the company provides digital tools for real-time travel advisories and safety information. They ensure travelers stay informed during their journeys.

This is trusted by over 6 million travelers per year. They are try to protect you from unnecessary problems. They serve 100% trip cancellation. And 2000$ for baggage loss and 250,000$ for medical. This is only for us residents. It also covers travel to Afghanistan, Belarus, Cuba, Iran, Myanmar, and North Korea. It also covers travel to Russia, Syria, and Venezuela.

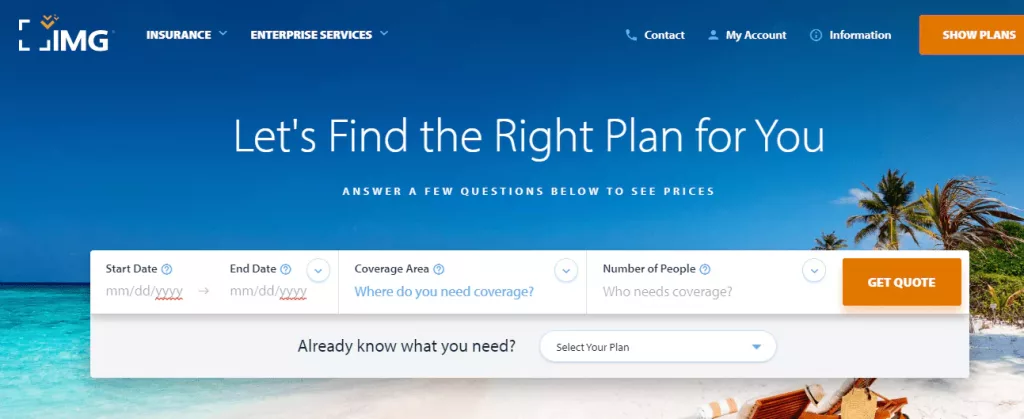

IMG :

IMG is a International Health and Travel Insurance company. It is a global company. They are offers travel medical,

international health,

and travel insurance plans.

Travel Medical Insurance protects you if you get sick while traveling abroad. It applies when you are outside your home country. Img provide full coverage for medical expenses while abroad. It covers medical care for people living in another country. It includes obstructive care, check-ups, and treatment. for illnesses and injuries. Conclusion In conclusion,

the top 10 travel insurance companies in 2023 offer a range of benefits and coverage. Each company has its own policy.

competitive pricing,

specialized plans,

exceptional customer service,

innovative technology.

Commonly Asked Questions (CAQs)

What cover travel insurance company?

They ae covers: trip cancellation and interruption.

It offers protection for unexpected medical expenses, lost or delayed luggage, and travel interruptions.

What is the price of travel insurance?

Travel insurance costs vary. They depend on factors. These include the traveler’s age, trip length, destination, and coverage limits.

What is factors for consider, while choosing a travel insurance policy?

You should consider many factors. These include coverage options and what’s in or out of the policy. They also include pricing, customer service, and extra benefits or perks.

Do I extend my travel insurance coverage while abroad?

It depends on the insurance company. Some may allow extensions, while others may require to apply for a new policy.

Is existing medical can be covered by travel insurance?

Some travel insurance companies cover pre-existing medical conditions. Others may exclude them. The most important thing is to review the policy, terms and conditions.

How can I compare different travel insurance plans effectively?

To compare plans well, consider factors. These include coverage limits. They include information on the cover in the policy, pricing, customer feedback, and the reputations of the insurence.

after booking my trip can I claim travel insurance?

Many times, travelers have the option to buy travel insurance even after they have already made their trip reservations. However, you should buy insurance soon. It will maximize coverage.

Is travel insurance worth it?

Travel insurance can give financial protection. It also brings peace of mind in unexpected situations. It’s worth considering for travelers seeking to reduce risks.

What type documents are need for claim a travel insurance ?

The required documents may vary depending on the nature of the claim. You commonly need certain documents. They include the claim form. They also have the right receipts or invoices. They have proof of travel and supporting claim documents.

How long does it usually take to process a travel insurance claim?

The time to process travel insurance claims can vary. It depends on the insurer and the claim’s complexity. It’s good to contact the insurance company. They have the specific information about claim processing times.